In today’s apple industry, it’s well understood that the right proprietary variety can demand premium returns.

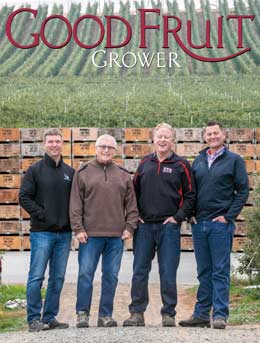

But almost 20 years ago, Stuart and Scott McDougall were jumping into the unknown when their winning bid earned them the exclusive U.S. rights to the Ambrosia variety. It was the right apple at the right time.

“Ambrosia, along with Pacific Rose and Jazz, was probably the first club apple in our industry,” said Scott, president of McDougall and Sons of Wenatchee, Washington. “So, the nice thing about that, as we look back, is we didn’t have this huge competition. Compared to the landscape now, it was a lot easier. And we started very slow.”

Today, McDougall and Sons has 800 or so acres of the variety that “changed everything for us,” Scott said.

Given the massive upfront investment in modern orchards, which Scott puts at $65,000 per acre before you get to pick any fruit, growers need varieties that can return above the costs of production. A decade ago, Ambrosia, Jazz and Pacific Rose delivered that, enabling the company to grow at a scale to survive the industry’s current era of consolidation.

“Ambrosia gives us a better return to the dirt than any other option,” he said.

Managed varieties certainly do fall out of favor; McDougall and Sons recently pulled out its last 150 acres of Pacific Rose, while returns on Ambrosia and Envy remain high. But the company continues to look for the next apple worth its investment.

“We just always look at everything,” said Bryon McDougall, company vice president and Scott’s nephew. “We never want to stay static or miss an opportunity.”

It’s an ever-rising bar.

“There’s not going to be more shelf space. Red Delicious got cannibalized. Gala is going to get cannibalized,” Scott said. “The next apple has to be better.”

Meanwhile, Ambrosia’s patent expired in 2017, and many more growers across the U.S. have planted it, seeking an open variety with proven returns above the costs of production.

To protect their brand as the original Ambrosia growers, McDougall and Sons launched a new brand identity: Ambrosia Gold. They aim to differentiate their experience and reputation for quality to retail customers, not to confuse consumers into thinking it’s a new kind of Ambrosia, Bryon said.

However, they also want to see all the new Ambrosia growers succeed, so the fruit retains its reputation for quality.

To that end, here are some tips on tackling Ambrosia, from the grower in the U.S. who knows it best:

—“It’s a grower-friendly apple,” Scott said, providing relatively consistent cropping. He initially planted it tight on Budagovsky 9 rootstocks, like the Canadian growers do, but he found that on the weak rootstock, the fruit size was smaller. In Honeycrisp, that may be an advantage, but not for Ambrosia. Now, he prefers a 3-foot by 10-foot spacing.

—As for rootstock recommendations, it’s about knowing your soils and your sites, he said.

—Ambrosia doesn’t thrive in the heat; McDougall and Sons has pulled out plantings in Mattawa, Washington, a more arid region south of Wenatchee.

—Harvest timing poses a challenge. “It has no acid and it’s an ethylene machine, so you’ve got to get it off the trees,” Scott said. Investing in the H-2A program was critical for their success with Ambrosia; they needed the labor to ensure they could get the crop picked at the optimum timing.

—Balancing color and maturity can also be a challenge in a year like 2022, when weather conditions weren’t conducive to coloring. “Last year, we picked 80 percent of our fruit in the first pass; this year, 30 percent,” he said.

—Proper storage is also key. People originally saw it as a summer apple, “meaning it’s a beautiful apple, but it’s not going to hold up three months,” Scott said. But SmartFresh (1-methylcyclopropene , or 1-MCP) hit the market around the same time they invested in Ambrosia, and it enabled them to dial in the storage protocols.

—by Kate Prengaman

Leave A Comment