—story and photo by Ross Courtney

—graphic by Jared Johnson

Low juice grape prices went even lower.

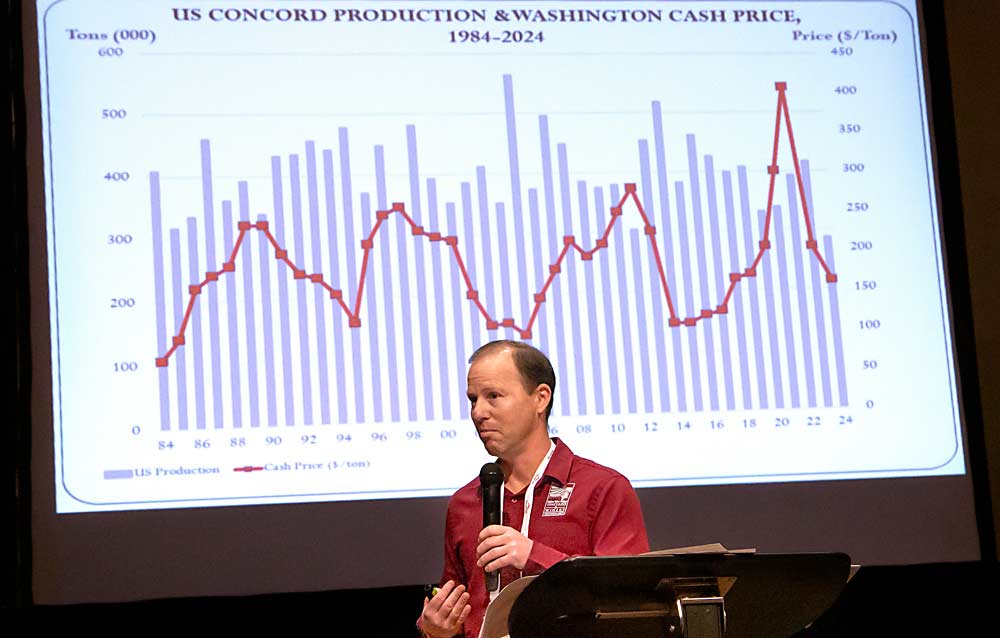

After cash prices for many Washington Concord grapes plummeted in 2023, they dropped further for the 2024 harvest, said Trent Ball of Yakima Valley College.

“Not good; that is not a good graph,” said Ball, who delivered the annual State of Grapes presentation in November at the Washington State Grape Society annual meeting in Grandview.

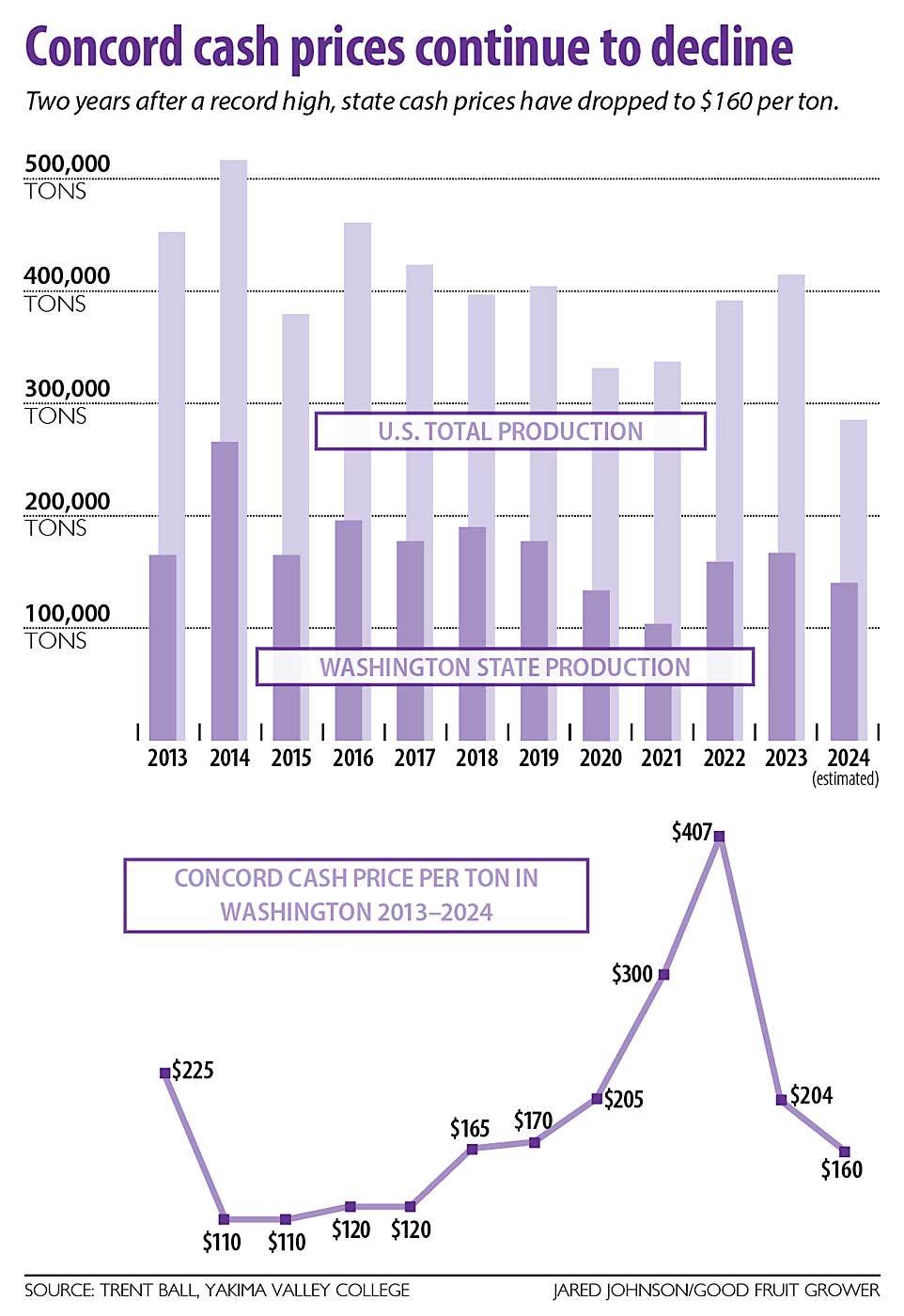

Washington’s weighted average cash price was $160 per ton in 2024, down from $204 the previous fall.

And just like last year, Ball has few explanations.

“Based on the information I have, it’s a head-scratcher,” he said in a follow-up interview with Good Fruit Grower.

According to Ball’s calculations, Washington growers who sell to processors, rather than those under contract to the Welch’s cooperative, should have received more than $200 per ton in 2024.

Ball has compiled his industry report annually for more than 20 years, based on communication with growers and processors. They don’t tell him everything, of course. It is possible processors doubt the quality of the concentrate they have in inventory or have lost large buyers, he said.

Also, that cash price does not include the contract prices paid by the nation’s largest juice grape processor, the National Grape Cooperative Association, which markets the Welch’s brand.

Welch’s growers reported decent prices this year, “in the $400 range” for grapes, said Carter Kilian, a Sunnyside grower. Kilian, a Washington State Grape Society board member, has some acreage contracted for Welch’s and some that he sells to the J.M. Smucker Co.

Smucker’s dropped its price from $380 per ton for 2023’s crop to only $170 this year, said Grandview grower David Golladay.

“Just because they can,” Golladay said.

That’s about 60 percent of his cost of production, he said.

The price was an even bigger shock because the company told growers in late 2023 it needed more grape volume to keep up with demand for its products, primarily Uncrustables, Golladay said. The J.M. Smucker Co. expects the frozen, prepackaged, crustless peanut butter and jelly sandwiches to surpass $1 billion in sales by 2026, after construction of a 900,000-square-foot production facility in Alabama, according to a recent news release from the company that owns the Smucker’s brand. Up until 2023, processor prices lined up closely with each other, Ball said.

Supply and demand shed no light on the price surprises.

Washington and the Eastern U.S. production regions both harvested volumes well below their respective 10-year averages. Washington brought in 138,000 tons, compared to a 10-year average of 172,000. The Eastern region also collected about 138,000 tons, compared to its 197,000-ton average.

Production areas began removing acreage about 10 years ago, as a reaction to low prices, though Washington’s harvested acreage inched up just slightly in 2024.

The price gap between East and West cash prices was nearly $200 per ton for 2024. The East typically sees higher prices, but only by about $30 to $50 per ton, Ball said.

“It’s a huge stratification,” Ball said.

Smucker’s did not reply to messages from Good Fruit Grower. Neither did Milne Fruit and Fruit Smart, the other two processors who purchase Washington Concords.

Concentrate prices, which fuel grape cash prices, don’t explain much either. Washington received about $15 per gallon of concentrate, Eastern growers about $17. Those aren’t record prices, but they are above average.

Ball was unsure what the future would bring.

“What’s cash price going to do? I don’t know,” Ball said. “It should have gone up.” •

Leave A Comment