The United States will produce 247.7 million bushels of apples in 2019.

That’s according to the U.S. Apple Association, which announced its estimate Aug. 23, during its annual Apple Crop Outlook & Marketing Conference in Chicago.

The USApple estimate was smaller than the USDA estimate of 253.1 million bushels announced on Aug. 12 (both USDA and USApple count bushels as 42-pound units).

If USApple’s estimate holds, 2019 will be an average-sized crop, 1 percent larger than 2018 but 1 percent smaller than the five-year average.

Mark Seetin, USApple’s director of regulatory and industry affairs, said that USDA’s annual August estimate (and subsequently USApple’s, which builds on USDA’s) is now based on production from seven states instead of 20. Those top seven states, however, represent 94 percent of the U.S. apple crop.

According to the USApple estimate, the Western states (Washington, California, Oregon) will produce 174.9 million bushels, up 3 percent from 2018 but down 1 percent from the five-year average. Washington will produce 165 million bushels, up 3 percent from 2018 but down 1 percent from the five-year average.

California will produce 6.5 million bushels, up 14 percent from the five-year average, and Oregon will produce 3.4 million bushels, down 13 percent from the five-year average.

The Eastern states (New York, Pennsylvania, Virginia) will produce 47.5 million bushels, down 4 percent from 2018 and down 2 percent from the five-year average.

New York will produce 31.5 million bushels, down 5 percent from last year but equaling the five-year average. Pennsylvania will produce 11.5 million bushels, down 1 percent from 2018 and down 5 percent from the five-year average. Virginia will produce 4.5 million bushels, down 6 percent from 2018 and down 5 percent from the five-year average.

The Midwest estimate, based solely on Michigan, was 25.2 million bushels, up 1 percent from both 2018 and the five-year average.

Too many varieties?

Randy Riley, director of produce merchandising for The Kroger Co., gave the conference’s opening presentation and sounded a note of warning: U.S. apple consumption has shrunk by 11 percent in the last five years.

“Apples continue to lose meaning nationally,” Riley said, citing competition from fruit with superior marketing strategies, such as Cutie oranges or Cotton Candy grapes. “You are losing your customer to these other categories.”

He mentioned emerging trends such as fad diets — and perhaps the most disturbing trend for the future of the industry: Millennials don’t eat as many apples as have baby-boomers.

Reports of tariffs and trade wars, as well as mergers and acquisitions in the agriculture industry, can also cause confusion and concern for customers, Riley said.

But the most relevant reason he gave for the decline in consumption — at least for the USApple audience — was internal competition. In other words: There are too many apple varieties on store shelves.

The industry hasn’t done enough to remove inferior apples from the market as new, superior varieties move in, Riley said. And that’s the opinion of a retailer. Imagine what it’s like to be a consumer.

“At the end of the day, the customer is confused,” Riley said. “They are not the experts we think they should be, nor will they ever be.”

Besides culling less-than-optimal varieties from the market, Riley said the best way the industry can fight the decline in consumption is by renewing its focus on consumer marketing. This would include more engaged marketing campaigns (emulating successes in other fruit categories), greater innovation in things such as packaging, and taking advantage of apple-friendly fad diets.

Fortunately, when it comes to marketing, apples have a lot of positive attributes to build on.

“You have crunch, which your competition does not,” Riley said. “You have different taste profiles. You have value. You have shelf life.”

Riley mentioned one variety in particular as “dead weight” — a variety that’s become the scapegoat for the apple industry in the national media: Red Delicious.

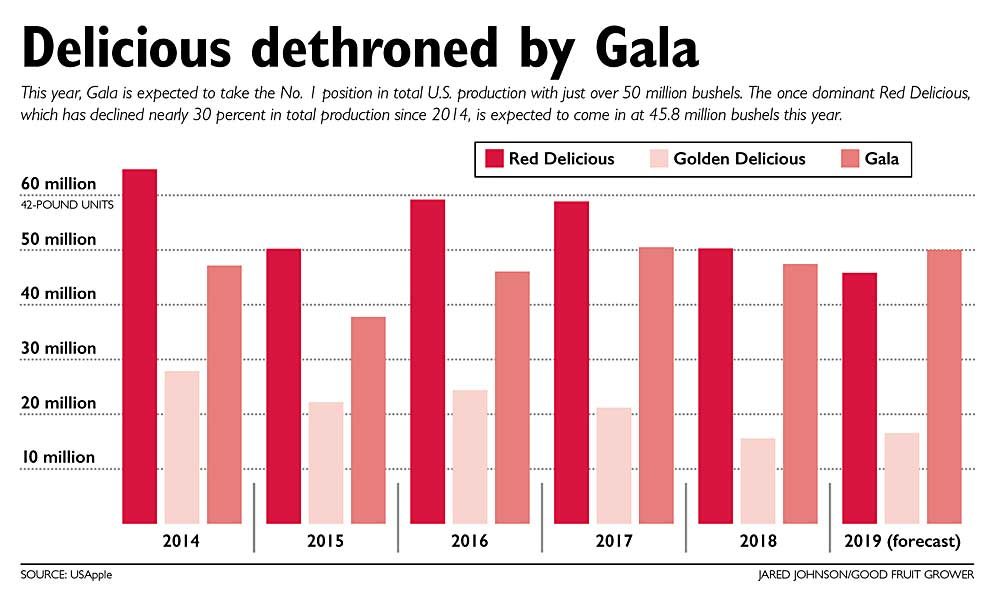

Last year, it was predicted that Gala would overtake Red Delicious as the top variety by volume, knocking the long-time champion off the throne. However, when the final count of the 2018 crop was made, Red Delicious was still on top with 50.2 million bushels; Gala followed at 47.4 million bushels. In 2019, Gala is once again forecast to overtake Red Delicious.

The decline in production of Red Delicious, as well as Golden Delicious, is one of the defining trends of the last two decades, Seetin said. In 2000, those two varieties made up 57 percent of production. Now, they’re at 25 ercent, and still falling.

Despite the steady decline of Red Delicious, however, the industry still grows about 10 million to 12 million more bushels of that variety than the domestic market can accept. But it remains a crucial variety for export markets, filling about 50 percent of export volume, Seetin said.

“When those markets are denied to us, it can cause some consternation,” he said.

On the other side of the coin, Honeycrisp continues to grow in popularity. The fifth most popular variety in 2018, Honeycrisp is poised to overtake Fuji and Granny Smith, and could be No. 3 by next year, Seetin said.

International estimates

Michael Choi, president of Zhonglu America Corp., said the world’s top apple producer will be back to normal in 2019: China will produce 43 million metric tons (about 2.2 billion 42-pound bushels). That will be a 34-percent increase from the 2018 crop — a crop that was unprecedentedly low, after a spring cold snap killed blooming flowers in China’s western growing regions and devastated their apple trees.

The 2018 reduction lowered inventories, raised prices and forced many growers to get jobs in urban areas just to feed their families, Choi said.

China remains a voracious apple consumer, with about 85 percent of its 2018 crop going to fresh domestic consumption. Its export percentages are relatively small, primarily to Bangladesh, Indonesia, Russia, the Philippines and Vietnam, Choi said.

European production is estimated at 10.5 million metric tons (about 551 million 42-pound bushels), down 20 percent from the bumper crop of 2018 and down 11 percent from the five-year average.

The decline in production will be led by Europe’s largest producer, Poland, which will produce 2.7 million metric tons this year, down 44 percent from 2018 and down 30 percent from the five-year average.

Italy will produce 2.1 million metric tons, down 3 percent from 2018 but equaling the five-year average.

France will increase production with 1.6 million metric tons, up 12 percent from 2018 and up 1 percent from the five-year average, said Philippe Binard, secretary general of the World Apple and Pear Association.

In South America, Chile will produce 1.6 million metric tons of apples, Brazil will produce 1.1 million metric tons and Argentina 608,000 metric tons, said Rene Alarcon, commercial manager for Doehler North America.

Meanwhile, Mexico will produce 27 million 20-kilogram boxes (roughly 44-pound boxes) of apples in 2019. Its largest production state, Chihuahua, will supply 23 million of those boxes — a bumper crop for the state, which averages about 18 million boxes.

There will be a lot of apples competing in a tight market this season, said Leighton Romney, CEO of Paquime Group.

And to the north, Canada will produce 18.8 million bushels of apples, down 2.3 percent from 2018 but up 1.9 percent from the five-year average. Ontario will supply 7.2 million, Quebec 5.3 million, British Columbia 4 million, Nova Scotia 1.9 million and New Brunswick 145,000, said Don Werden, who works on sales and logistics for the Norfolk Fruit Growers’ Association. •

—by Matt Milkovich

Leave A Comment