Blueberries are bigger and tastier than they used to be, thanks to the work by plant breeders. Berries are also versatile, available fresh, frozen, canned, and dried.

Photo by Scott Bauer, USDA Agricultural Research Service.

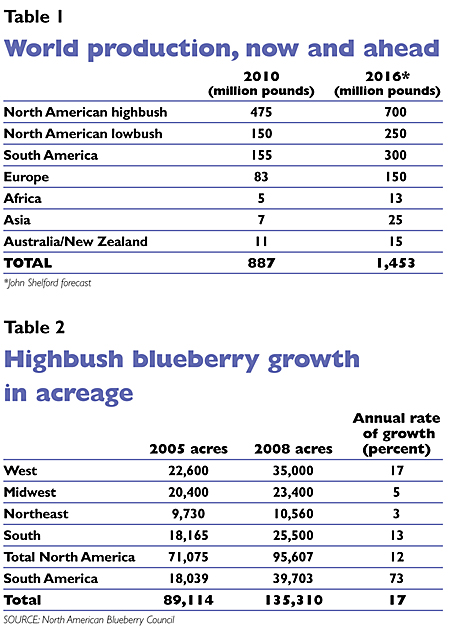

From a relatively minor industry producing about 100 million pounds of fruit annually a generation ago, production reached 887 million pounds in 2010, according to John Shelford, a long-time blueberry industry observer, analyst, and marketing expert. And there are enough plants in the ground to elevate that to 1.5 billion pounds in 2016.

“I wouldn’t believe it if I hadn’t lived it,” Shelford said. He started his work for MBG Marketing, based in Grand Junction, Michigan, in 1976 and is now the chief executive officer of frozen sales for Naturipe Farms.

In David Brazelton’s view, “Blueberries were the right crop at the right time with the right information.”

Brazelton, owner of Fall Creek Nursery in Lowell, Oregon, was an early believer in the potential to grow blueberries well outside traditional production areas. He built his business over the last 30 years by providing plants to growers who shared the belief that the blueberry business would grow if they could plant the right varieties.

Tremendous growth in production was accompanied by a steadily increasing price and steadily increasing consumption, a triple-whammy combination that doesn’t happen very often. Not only are more people eating blueberries, but each person eats more each year.

From 2005 to 2008, acreage in the United States grew from 71,000 to more than 95,000, for an annual growth rate of 12 percent, according to Shelford’s figures. In the West—Washington, Oregon, British Columbia, and California—the growth was even more spectacular, rising from 22,600 acres in 2005 to 35,000 in 2008. That’s 52 percent growth in three years.

The West is now the leading producing region, surpassing the South, which itself has been growing rapidly. The traditional production areas in the Northeast (New Jersey mainly) and the Midwest (Michigan mainly) have been dwarfed by production in new areas. The annual growth rate has slowed to 3 percent in the Northeast and 5 percent in Michigan, but even in these traditional areas, acreage is still rising (see table).

In addition, countries in South America—Chile, Argentina, Uruguay—have entered the fray, with an acreage growth rate of 73 percent over those three years.

Overall, in the Western Hemisphere, acreage grew from 89,114 in 2005 to 135,310 in 2008, for an annualized growth rate of 17 percent.

Moreover, Shelford said, both consumption and production is increasing in nontraditional areas—Poland, Germany, Serbia, Spain, Ukraine, China.

What is even more exceptional is price. This year, the price per pound will come close to $1.50, a new record high.

Healthful fruit

Scientific information on the health-promoting effects of blueberries began to emerge in the late 1990s just as Baby Boomers, the let’s-never-say-die generation, were turning 50 and starting to witness evidence of their own mortality. Studies showed that blueberries, of all the fruits and berries, are one of the highest in antioxidants. Research indicated that antioxidants could not only slow the effects of aging, but actually reverse them.

As more research was published, the media reported that eating blueberries could potentially slow or reverse memory loss and cognitive decline, help restore balance and put some spring back in one’s gait, improve problem-solving ability, improve failing eyesight, and ward off macular degeneration. Antioxidants reputedly prevent cancer, stroke, heart disease, and Alzheimers.

USDA research is still generating new health findings. In the fall of 2010, a USDA-funded study added atherosclerosis—hardening of the arteries—to the list of bad stuff that blueberries fight.

This health information provided a kick start for what had been already a growing industry. The Fountain of Youth had been discovered.

More expansion

Huge increases in production make growers worry, and growers in Michigan are routinely advised that the industry has matured and no more plantings should be made.

Brazelton agrees, it can be scary. But, he says, “You can’t use old rules to think about new opportunities.” The next five to ten years will be challenging, he says, “but I can’t think of another crop I’d rather be in.”

While production is rising, it’s still a fraction of what strawberries are. Blueberries are virtually unknown to most people in the world. “Demand in China is exploding,” he said. Demand is growing in India, Russia, and in the Middle East.

He thinks we’re witnessing “a paradigm shift in consumption of all things blueberry.”

The fruit can be eaten fresh, frozen, or dried, and there is no large price penalty for processed fruit. It can be harvested by hand or by machine, either for fresh or processing. It’s people friendly to harvest.

Packaging has changed from the old paper containers to clear plastic clamshells. “Blueberries are convenient and easy to eat,” he said. “Preparation is easy,” Shelford adds. “There’s no peeling or cutting.”

The flavor of blueberries is not intense, Shelford said. “It’s a flavor most people like, mild enough for everybody.”

Blueberries seem to be everywhere, Shelford said. Fresh ones are eaten like candy or added to cereal. Frozen ones are in muffins and yogurt. Dried ones are in nutrition bars and trail mixes. Ocean Spray has mixed them with other fruits and put them in juices.

Forces have been at work on the marketing side.

One is MBG Marketing. Back in 1976 when Shelford joined, the name was Michigan Blueberry Growers.

“People thought we were a trade association,” he said, “so, we changed the name to MBG Marketing.”

People also thought the company mostly marketed Michigan-grown blueberries, but it expanded into new territory as production spread. It was, and is, a driving force in blueberry marketing, and is now a part of Naturipe, a huge marketer of berries of all sorts.

In 2000, Shelford became president of Naturipe Farms, a partnership between MBG Marketing and Hortifrut SA, Santiago, Chile. MBG Marketing is the largest marketer of blueberries. He is now part of FreshXperts, a group of consultants serving clients in the fresh fruit and vegetable industry.

Little Blue Dynamos

Two other things have helped blueberries grow. One is a federal promotion and research order, established in 2001, which set up the National High Bush Blueberry Council. “There are no marketing aspects and no supply controls,” Shelford said. “What it does is collect $12 a ton to fund research and promotion.” The assessment is made on both domestic production and imports, paid by producers and importers. It raises about $4 million a year to spend on generic promotion and market development.

In May this year, the council launched its Little Blue Dynamos campaign.

Promotion was once done through the North American Blueberry Council, located in Folsom, California, which was created in 1965 and used voluntary contributions to promote the industry. Today, NABC provides its members with market information and support services—monthly cold-storage reports, statistical analysis, trade leads.

“The industry had a lot of cohesiveness from the start,” Shelford said. At one time, much of that came from MBG Marketing, but today there are a lot of sellers, he said. “MBG’s market share is only half what it once was,” he said.

A new addition to the picture is the International Blueberry Organization, created last year and bringing in charter members from Mexico, Argentina, Australia, New Zealand, British Columbia, Chile, South Africa, the United Kingdom, and, of course, the United States through the North American Blueberry Council.

Leave A Comment