Despite hand-wringing over greasy fruit, green spot and a pandemic, the Cosmic Crisp apple remains the highest-priced major apple on store shelves. Prices would be even higher if growers could bring down fruit size.

Those are among the messages from sales data from the 2020–2021 season, shared by Kevin Brandt, vice president and chief operating officer of Proprietary Variety Management, the company contracted to commercialize the WA 38, Washington State University’s cultivar trademarked as Cosmic Crisp.

“When you find success during a pandemic like Cosmic Crisp did, I’d say that you are doing quite well,” Brandt said.

Brandt told growers at the Washington State Tree Fruit Association Annual Meeting in December that the Cosmic’s average price on store shelves was $2.67 for the 2020–2021 marketing season, highest among the top 15 varieties by volume in the U.S. market, according to Nielsen data. The Honeycrisp was second at $2.46 per pound.

It fetched an average of $46.88 per box f.o.b. for all grades, he said, based on data from the company’s Idyia database. However, 85 percent of all the Cosmics packed reached the highest grade of Extra Fancy, which averaged $51.29. Those figures have crept up since then, after more data was reported, Brandt said in a follow-up discussion with Good Fruit Grower.

“Whether you think that prices should be higher or not, the WA 38 cultivar sold under the Cosmic Crisp brand name performed exceptionally well in this overly crowded field of branded apple selections — in a pandemic nonetheless,” Brandt said.

Shippers found little market for the second — and only other — grade of Washington Fancy, which averaged $30.57. That grade has since been replaced with U.S. Fancy.

The f.o.b. price fell below the blistering start of $63.92 per box for the apple’s rookie season in 2019–2020.

It also fell below a $55-per-box assumption used by WSU’s Scot Hulbert to project royalties at industry meetings in 2021. That was just a rough average for the time, based on reports ranging from $40 to $70, Hulbert said.

That doesn’t surprise Brandt. Most apples saw low prices in 2020–2021.

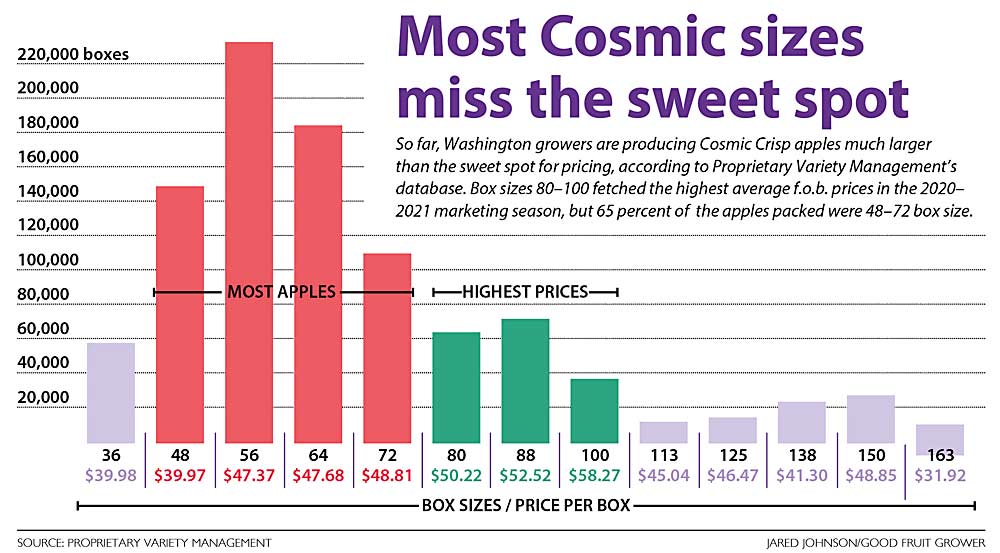

The industry also is experiencing a disconnect between the highest-priced fruit size and the most common sizes.

Box sizes 80, 88 and 100 fetched the highest per-box prices of $50.22, $52.52 and $58.27, respectively, but 48, 56, 64 and 72 box sizes comprised 65 percent of the crop.

That’s not surprising either, said Ines Hanrahan, director of the Washington Tree Fruit Research Commission.

The WA 38 will always skew large, considering one of its parents is the Honeycrisp, also a large apple that fetches high prices, Hanrahan said. But she expects growers will find ways to mitigate fruit size as they gain more experience with the apple.

Data suggests sizes will also come down as trees mature. The 2020 crop came mostly from third-year trees.

In precommercial trials in Prosser and Quincy, more than half of the fruit volume in the second year of production was within 48–56 box size, according to a 2020 Washington State University report. The peak box size shifted to 64–72 as years went on. Fruit size peaked at 80–88 in only one case.

Even when yields were high, such as 93 bins per acre one year in Quincy, fruit size peaked at 64–72 bins per acre.

Indeed, apple prices were down in 2020–2021 overall, agreed Brian Focht, manager of the Washington Apple Growers Marketing Association, due to in-store marketing restrictions because of the pandemic, export limits and shipping problems.

Apple prices should climb in the rest of the 2021–2022 season as shippers move a shorter overall crop, Focht predicted.

Cosmic Crisp, on the other hand, will settle in price more firmly in the $40–$50 f.o.b. range, just because the volume is higher than the previous season, he said. Focht also expressed concern about slow movement in November and December, due to limited freight availability and a variety of other factors.

“At some point, we’re going to have to enhance movement,” he said.

However, prices may hold more consistent throughout the season, simply because the larger volume will enable shippers to fill the market all year.

“We expect it to go around the horn,” he said.

—by Ross Courtney

Leave A Comment