Creating impulse demand among online shoppers has been on the to-do list of sweet cherry marketers for years. The coronavirus outbreak just pushed it to the top.

“We’ve got an impulse item, and now all of a sudden people are shopping from home like never before,” said James Michael, vice president of North American marketing for the Northwest Cherry Growers.

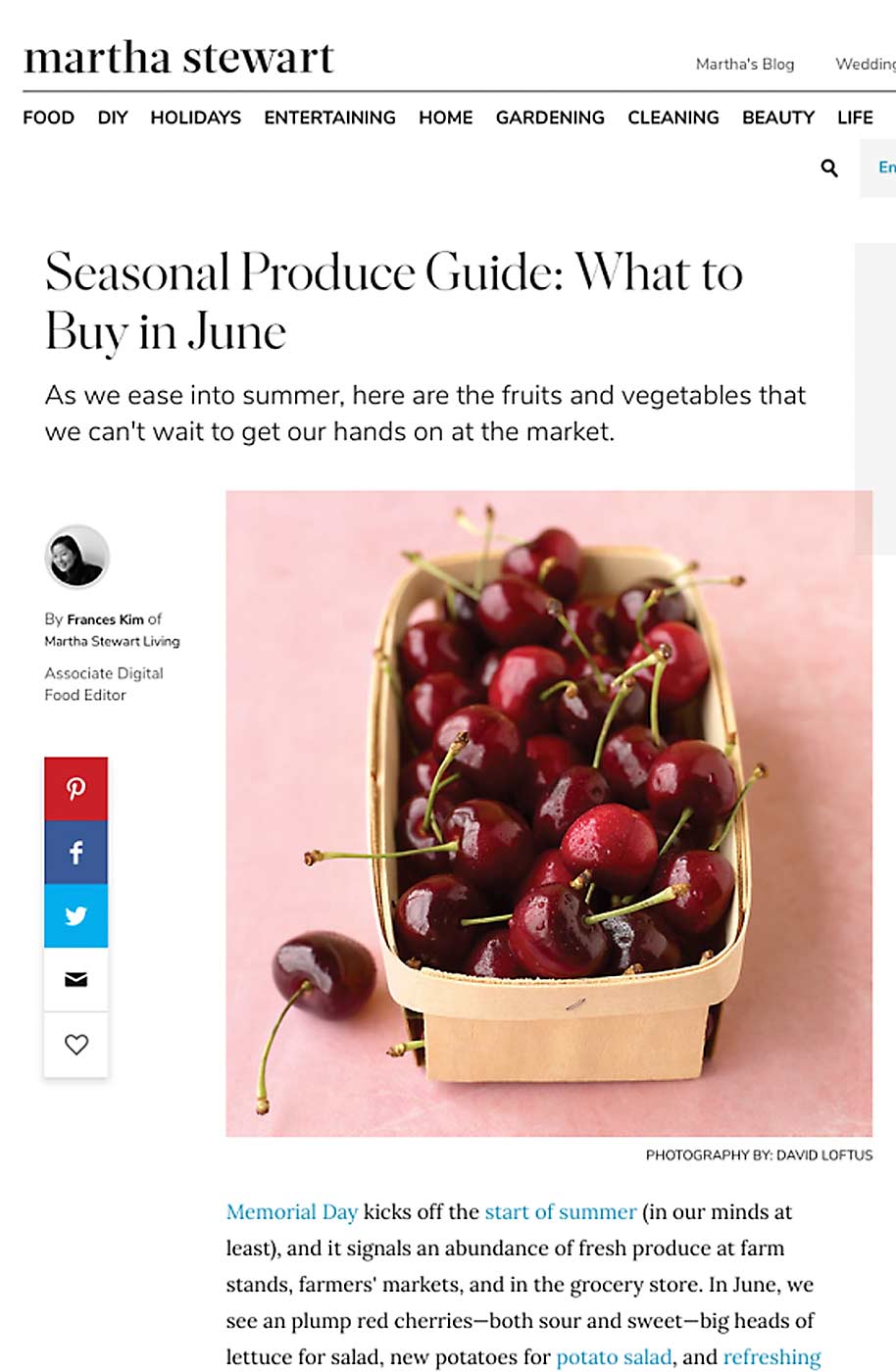

Sweet cherries have long relied on impulse purchases; 72 percent of shoppers buy cherries just because they see them displayed in a store, not because they were on a shopping list, Michael said.

Cherries also generate the most dollars per square foot of any grocery item in July. That’s why grocers display them boldly and colorfully near the front of their stores. Northwest Cherry Growers runs promotion and display contests for its produce managers.

Meanwhile, online grocery shopping had been rising with the advent of services such as Instacart, Amazon Fresh, Costco delivery and curbside pickup — typically called “click-and-collect.”

Fresh produce had been a little later to the party, but it was already picking up pace, according to surveys by Category Partners, an Idaho Falls, Idaho, market analysis company contracted by Northwest Cherry Growers.

In a 2017 survey by the company, less than 1 percent of shoppers reported they most often purchased fresh produce online. In February this year, before the coronavirus changes, 17 percent of those surveyed said they shopped for fresh meat and produce through a click-and-collect service on a weekly basis.

Those aren’t exact comparisons, said Adam Brohimer of Category Partners. Online produce shopping isn’t always counted consistently, even by Nielsen data. But the numbers show change.

“There was nothing and now there is something, and that something was being accelerated,” he said. There’s also a long way for cherries to go; in North America they found that less than 1 percent of all Northwest cherry sales were online in 2019.

Brohimer recommended growers discuss these changes with their packing houses and shippers.

So, cherry marketers had been looking for ways to increase online awareness, something to mimic that in-store impulse. They purchased some online advertising, but that’s expensive; prime spots usually go to high bidders such as Nabisco or Pepsi.

Representatives have worked with produce managers to include cherries in social media updates, videos and direct emails to consumers, letting shoppers know that cherries are in season. They try to convince the platform administrators to set up algorithms that suggest cherries for online shoppers, without charging too much money.

Last year, Northwest Cherry Growers shipped 3,000 pounds of cherries to social media influencers who discussed their nutritional values and recipes online.

The pace quickens

In the wake of the coronavirus, habits aren’t changing so gradually now. In March, just a couple of weeks into the stay-home orders and advisories, one-third of consumers reported increasing their frequency of online grocery shopping, while 41 percent said they had decreased the number of trips to physical stores, according to a Category Partners survey.

Single-day downloads of apps such as Instacart, Walmart’s grocery app and Shipt were more than double on March 15, compared to the same date one year prior. Nielsen data and surveys by other research companies tell a similar story. Meanwhile, retailers report being overwhelmed, warning online customers to brace themselves for delays.

The other challenge for cherry marketers scrambling to adapt is that grocery managers are suddenly busier, wrangling with interrupted supply chains and stricter shopping measures required in the era of social distancing, said Neil Galone, a marketing representative for Northwest Cherry Growers. Normally, he spends April and May personally visiting produce managers in Northeast states, discussing cherry timing with them. This year, many of those managers are working from home and trying to put out other fires.

“They still want to think ahead because they know they have to, but they have less time,” Galone said. Galone now lives in Florida, after retiring from a career in fruit sales for various Northwest shippers.

Stemilt Growers of Wenatchee, Washington, one of the largest cherry shippers in the world, plans to double down on online marketing, trying to digitally convince shoppers they deserve a seasonal treat such as cherries. It was all on the five-year plan anyway, said Roger Pepperl, marketing director for Stemilt.

“We have to get there anyway, it’s just forcing us to bring on excellence earlier,” he said.

His message to growers is that quality and consistency become even more important when consumers are buying cherries online.

“They expect they’re going to be good; and if they’re not, they’re going to be pissed,” Pepperl said.

Michael echoed that. Shopping data has long told Northwest Cherry Growers that quality, not price, drives sales, even in-store. When you move online, repeat purchases are even harder to maintain. The picture on the website is always the same.

“Fortunately, that’s what Northwest cherries are known for,” Michael said. “They’re high quality.” •

Digital data

Surveys by Category Partners, an Idaho Falls, Idaho, market research company contracted by Northwest Cherry Growers, paint a picture of surging online grocery sales:

—In March, 18 percent of all grocery shoppers said they had begun using a click-and-collect service within the past three months. Only 7 percent had been doing so between three and six months ago.

—Also in March, 17 percent of shoppers said they had purchased fresh produce and meat weekly through click-and-collect.

—In the same survey, 33 percent of shoppers reported purchasing groceries online more often since the coronavirus, while 41 percent said they were making fewer trips to physical stores.

—In a 2017 survey, 10 percent of shoppers said they most often purchased groceries online, but only a fraction of a percent said they most often purchased fresh produce online.

Surveys and data from other sources show a similar story:

—In March, 31 percent of shoppers reported purchasing groceries online, compared to just 13 percent in August last year, according to a survey by marketing and sales consulting firm Brick Meets Click and online order fulfillment platform ShopperKit. Of those online shoppers, 43 percent said they would continue digital grocery shopping after the pandemic.

—Last year, just 4 percent of grocery sales in the United States came online, according to Nielsen data.

—Single-day downloads of Instacart, Walmart’s grocery app and Shipt increased 218 percent, 160 percent and

124 percent, respectively, on March 15, compared with a year prior.

—Online services accounted for just 3 percent of grocery spending, Bain & Co. reported last February.

—In August 2019, Gallup reported 81 percent of Americans never used online grocery shopping services.

—by Ross Courtney

Related:

—Online cherry promotion earns campaign of the year honor

Facebooks new shopping platform is designed exactly for impulse buying.