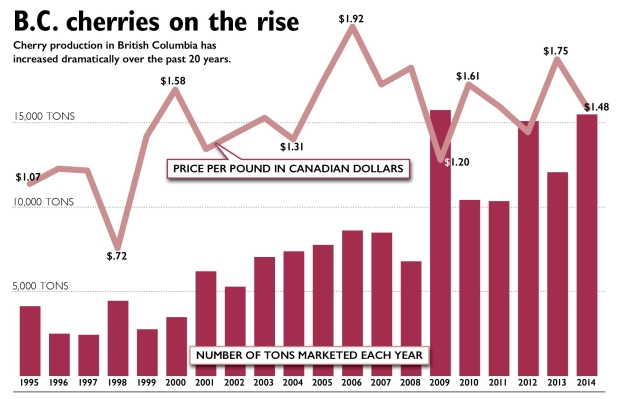

Cherry production in British Columbia has increased dramatically over the past 20 years. NOTE: AT current exchange rates, Can.$1.00 is equivalent to about U.S.$0.80. Source: Statistics Canada. Click to enlarge. (Jared Johnson/Good Fruit Grower illustration)

Cherry growers in British Columbia, Canada, are looking to exports as they juggle growing production, narrowing margins, and attractive market opportunities in Asia.

Growers harvested almost 15,500 tons of sweet cherries in 2014, the greatest volume since the record 15,668-ton harvest of 2009.

While prices held up at Can.$1.48 a pound, they were still below the five-year average of $1.52 a pound while production, harvesting, and other costs ate away at margins. (At the current exchange rate, one Canadian dollar is worth 80 U.S. cents.)

Still, growers such as Sukhpal Bal were busy this spring planting new acreage, confident that markets in China—where Canada recently secured market access for its cherries—will help keep Okanagan orchards viable. Bal added 40 acres to his Kelowna-area orchard this spring, which now totals 90 planted acres.

“We’re very confident because of the requests we keep on getting for fruit, and it really all ties in with this China agreement,” said Bal, chair of the B.C. Cherry Association. “That’s a very positive thing for the grower…and I expect with the new replant program that we just got from the government that you may see some people shifting towards cherries or giving cherries a try because of the market demand.”

Sweetheart, Staccato, and Sentennial are the favored varieties for replanting, because they’re later-season varieties that follow in the wake of the earlier varieties that the rest of the Northwest produces. By focusing on export markets, the industry has hoped to offset competition at home from Washington State, the target of dumping concerns in the mid-2000s.

“We’re needing those returns from the export markets to really justify growing cherries,” Bal said. “A lot of operations wouldn’t be able to sustain themselves by selling to the local grocery store because you have so much fruit coming in from Washington or other places. When you look at the numbers, we have to go to that export market to get the highest return for our product.”

Shipments of cherries sized 32 mm (8-1/2 row) and larger to China garner growers $3.50 to $4 per pound, or as much as the average cherry fetches at domestic markets after everyone’s added their markup.

Returns from the domestic market are simply not enough to cover land costs, which can run as much as $100,000 an acre, let alone piece rates for harvesters and the cost of coddling cherries to maturity against weather, pests, and diseases.

But demand from China, not to mention the countries negotiating the Trans-Pacific Partnership—a multilateral trade agreement that could open access to markets totaling 792 million people—offers growers hope that investments in sweet cherries will pay off.

“For the younger grower getting into the cherry business in the last little while, it’s a very expensive crop to look after,” Bal said. “But looking out to Asia, a quality product will sell any day of the week…and that’s what we’ve got to aim for.”

The good news is, the quality of cherries from Canada now has Beijing’s stamp of approval.

Cherries from Canada previously faced restrictions in export markets over concerns regarding cherry fruit fly, which lays eggs in ripe fruit.

The larvae eat their way out, damaging fruit while potentially invading new areas, unseen to all but the most zealous observers.

Those include Chinese inspectors, who watched over every shipment leaving B.C. orchards in 2013 to ensure that the protocols the industry put in place were guaranteeing clean fruit was entering export markets.

“It was very tightly controlled,” said David Geen, chair of the cherry association’s market access committee and president of Coral Beach Farms Ltd. in Lake Country. “The Chinese inspectors were here working with the Canadian Food Inspection Agency, and they had to look at, and sign off on, any shipment that left the country.”

But the shipments won high marks for cleanliness and quality, and 400 tons of exports in 2013 more than tripled last year to approach 10 percent of the provincial harvest. Chinese inspectors visited in July to ensure everything was in order, and this year shipments will proceed with the full trust of Chinese authorities.

The industry isn’t resting on its laurels, however. While fruit may be pest-free, there’s always room to improve quality to ensure the best reception in foreign markets.

“What we’re really emphasizing with our growers is that quality has to be of the highest and has to stand out above anything else that may be in the market,” Bal said. “With more acreage going in the ground, we want to give the resources to new growers to learn better techniques.”

To do this, the cherry association plans regular extension sessions, such as pruning demonstrations and other seminars designed to transfer knowledge from researchers and older growers to the next generation of producers.

“It all ties back to wanting to grow quality cherries and keep our reputation and image very high,” Bal said. •

Tips for exporters

Knowing how to prepare cherries for export is one thing; knowing how to prepare them for arrival is another.

Speaking to fruit growers at the Pacific Agriculture Show in Abbotsford this past January, Andre Bailey of Global Fruit Brokers Ltd. in Creston, British Columbia, Canada, emphasized the need to understand their product from the buyer’s perspective.

“Chinese markets absolutely will pay a premium for premium product,” Bailey said, while cautioning: “There is no market that demands perfection like China does.”

This means cherries should arrive overseas—typically in Hong Kong—in pristine condition because the cold chain in China, while improving, is quite unlike what growers can count on in North America.

This can damage fruit, damage that will be pinned on the exporter rather than the handlers in China.

“A good arrival can become a bad arrival in Hong Kong in no time at all,” Bailey warned. “A bad arrival will kill your brand in China.”

To address the risks, Bailey encouraged growers to develop a solid plan, have a backup plan in the event trouble arises, and purchase container insurance to protect against losses.

Container insurance is absolutely worth every penny, Bailey said, and a cost of doing business in one of the brightest export markets growers have today.

Cherries and other fruit are popular gifts during China’s Mid-Autumn Festival, but fresh fruit is also a staple of daily life.

“China is kind of the granddaddy of a market in terms of the ability to take a lot of product,” said David Geen of Coral Beach Farms Ltd. in an interview just before last year’s autumn festival. “Chinese culture is very much built on having year-round availability of fruit. In our window, particularly the latter part of August and into September, there’s not a lot of fruit.”

Hello There,

Looking for a cherry producer to purchase cherries for export to Vietnam.

If you can pass on my email charbour41@hotmail.com it would be appreciated.

We are lokingfor long term relationship.

My phone 1-905-464-4786

Company is MYS Trade Import Export Inc.

Thanks

Cliff, I passed along your request to the export manager with the Washington State Fruit Commission.