Over the years, Jim Divis noticed the increased demand for bagged apples as he sketched long-term plans for expanding and renovating Honeybear Growers’ packing line.

The coronavirus kicked bagging into overdrive.

“We’d been seeing that already, but the pandemic just fast-forwarded it,” Divis said. The same thing happened with packers across the United States, who pivoted to keep up with the surging clamor for packaged fruit.

In Honeybear’s case, Divis, the general manager, and his vendors went back to the drawing board for the already-planned expansion, which more than doubled the Brewster, Washington, building’s size. They created early drops for small, bag-destined apples — to reduce inventory, create flexibility and cut repacking in half. The company now has two separate, parallel lines: one for bags, one for trays — commonly called a hybrid in the industry.

“This is a new twist on a hybrid, because I’ve separated the bagging from the tray-filled section,” Divis said.

The same way the pandemic sped up the growth in demand for already increasing e-commerce and curbside grocery pickup, it created a boost in desire for grab-and-go purchases of fresh fruit among shoppers spending less time in store aisles.

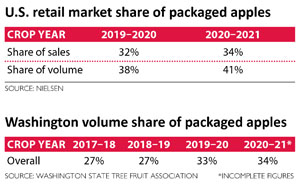

The U.S. market share of bagged or otherwise packaged apples went up by 6.25 percent in dollar sales and nearly 8 percent in volume between the 2019–20 crop year and the 2020–21 season, according to Nielsen statistics.

Part of that bump comes from U.S. Department of Agriculture food boxes — a temporary measure to counteract the economic ramifications of the coronavirus pandemic for struggling families and produce shippers — which leaned heavily on packaged fruit. But retail demand increased, too, said John Onstad, an industry consultant and former sales director for Sage Fruit Co. in Yakima, Washington.

“We’ll lose the USDA, but the retail will stick,” Onstad said.

Washington Fruit and Produce Co. went into 2020 with relatively new apple packing lines and a typical bagging share of roughly 25 percent of the volume, said Mikey Hanks, packing operations manager.

The pandemic blew that away. The Yakima company has added four more bagging machines to the 12 they had just finished installing and added 28 new weighers that more accurately target the desired volume of the packages.

And they still don’t have enough bagging capacity, he said. As an extreme example, one run earlier this year saw an 81 percent bag share.

“I don’t see it going back down, because everyone got addicted to the personal shopper idea,” Hanks said.

History

Bagging apples has been around for decades. Other consumer packaging has seen a rise, too, such as clamshell trays found at Costco and Chelan Fresh’s Rockit tubes.

Stemilt Growers was ahead of the curve on pouch bags, which usually stand upright with a flat bottom and feature zip closures and handles. The Wenatchee, Washington, company introduced Lil Snappers, small apples marketed as kids’ snacks, about a decade ago, said Brianna Shales, marketing director. The shipper has been on the path toward consumer packaging automation ever since, adding 18 pouch bag machines and eight poly bag machines on the Wenatchee campus.

And managers are glad they did. The pandemic pushed bag sales up 10 percent for Stemilt and its packing partners.

“We basically overnight saw an increased demand for any bagged product,” Shales said.

How the trend will affect growers is still unclear, said Jon DeVaney, president of the Washington State Tree Fruit Association. He has heard anecdotes of it helping and hurting. “It is a changing environment, so some of this we are in the process of finding out,” he said.

Packaging is more expensive for shippers and requires more inventory management, which could cut into grower returns. And growers still earn the best returns on large fruit, while small fruit is typically bagged.

But the trend could move more volume. Retail surveys show people typically buy more volume when they reach for prepackaged produce. And bags allow more space for marketing messages.

“The pandemic allowed us to sell a lot more of the smaller fruit,” said Chuck Sinks, president of sales and marketing for Sage Fruit. The company recently saw such an increase in bag demand that it sometimes ran low on supplies.

Future

The surge in demand also comes at a time when the industry is rolling out new varieties, which lends itself to loose, piece-by-piece shopping. What customer is going to gamble on a 5-pound bag of an apple they have never tried? And demographically, the U.S. is seeing an increase in smaller households, which don’t lend themselves to large purchases.

“So, you got two competing trends there,” said Don Armock, president of Riveridge Produce Marketing of Sparta, Michigan.

The pandemic didn’t change much at Riveridge’s four packers, Armock said. Eastern apples skew smaller, so the packers in the region have always had a larger share of bags than in the Pacific Northwest. If anything, the rise of the beefy Honeycrisp swung Eastern packers toward more tray packing, he said.

Package types also change with society’s priorities. The pandemic brought a temporary pause to the push to reduce single-use plastic, said Cynthia Haskins, president and CEO of the New York Apple Association. But it’s already returning.

Once again, stores are encouraging customers to bring in their own shopping bags. Before the pandemic, New York banned single-use grocery sacks, though produce pouches from the supplier were exempt. Many shippers have been testing compostable plastics, while the New York Apple Association released branded paper totes this fall.

Back at Honeybear

At Honeybear’s Brewster facility overlooking the Columbia River in North Central Washington, automation, efficiency and quality are the big words, Divis said. The baggers can run 20 hours per day, cranking out two 1,000-box loads of bagged apples per day in poly, pouch or mesh. Overall, the company reduced labor needs by 10 employees and runs more than twice the fruit.

However, equipment alone couldn’t solve all the problems. While they installed new baggers, about 60 percent of the company’s apples are Honeycrisp, compared to about 14 percent of Washington’s overall crop. Honeycrisps run large, meaning a smaller share are bagged. Having more new bagging machines ready and waiting would be a waste, Divis said.

Instead, Honeybear’s innovation comes in the layout.

Shortly after the dump tank and first wash, the smaller apples — usually 113 row size and smaller — drop into new bins and head back to storage. The larger fruit continues along the tray-pack line.

When customers want bags, those smaller bins go to a separate line with its own dump tank, washer, waxer, drying tunnel and system of conveyors that lead to the automatic bagging machines. With small apples diverted early, the company hopes to cut costly repacks by half and gain half a box per bin overall, Divis said.

Divis also left open space in the massive building for new packaging equipment, as the industry continues to evolve.

The interconnected reconfiguration took a lot of fine-tuning for Divis and his packing supervisors. More than he expected.

“I underestimated how much work it was going to be, so it made these guys want to pull their hair out for about three months,” he said.

—by Ross Courtney

Leave A Comment