Things are looking up for Washington’s Concord grape growers, though there may be fewer of them now.

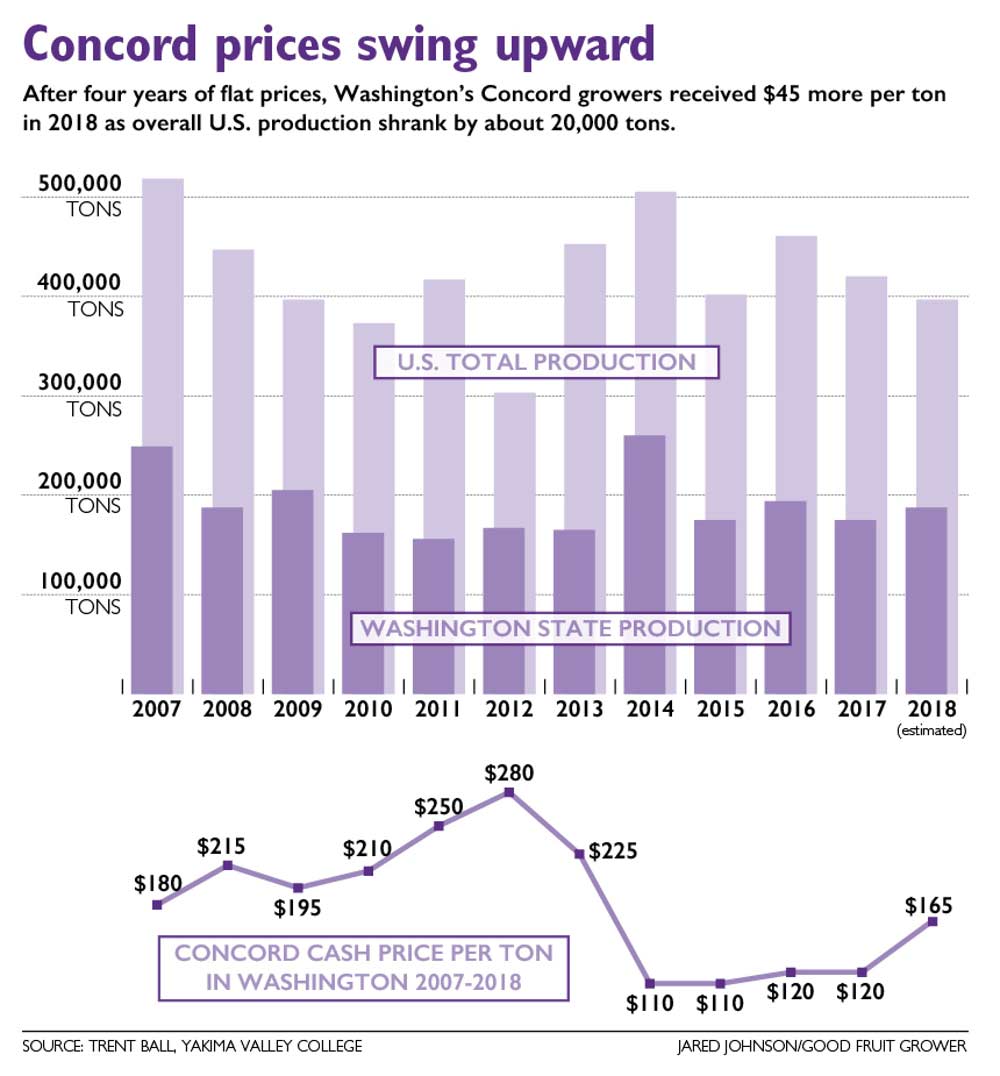

Five years ago, Washington growers had about 22,000 acres planted in Concords, but that has fallen to 17,500 acres today — the lowest since the 1970s, said Trent Ball, the agriculture program chair at Yakima Valley College and instructor in the Vineyard and Winery Technology Program. The shrinking supply is finally driving the price up so that growers received $165 per ton last year. That’s up from $120 in both 2017 and 2016 and $110 in 2015 and 2014.

“It’s helping to reset the market,” he said of the decline in acreage. “There is still a likelihood that more acreage will come out, but not as much as we saw in 2016 and 2017.”

Ball compiles statistics on the juice grape market for the Washington State Grape Society’s meeting every November.

It was nice to have good news for a change, he said.

Nationally, the Concord harvest came in at 398,000 tons, with Washington accounting for 187,000 tons. Growers in the Lake Erie region of New York and Pennsylvania were close behind, harvesting about 175,000 tons. Prices were higher in the East, about $200 a ton on average, Ball said, as winemakers also sought more Concord juice.

“This is the lowest national production we’ve seen since 2012,” Ball said.

He added that juice imports are trending down, while exports, largely to Canada, are up. For the most part, Eastern processors have sold out of stored inventory as well.

“So, things are looking better,” he said. “The outlook is positive going forward, so that’s a nice thing to be able to share with you.”

Washington growers enjoyed an ideal season, weather-wise, with near record yields and strong sugar development.

Prices for organic grapes rose to $215 per ton, but it’s still a very small portion of the harvest, estimated at just 11,426 tons. Washington growers also harvested 18,000 tons of Niagara grapes from about 1,200 acres of vineyards.

While he predicts the cash price is likely to continue to climb a bit as supply and demand come back into a better balance, Ball cautioned that demand is not growing.

“The reality is that consumers are not buying more juice. That’s our new normal,” he said. •

—by Kate Prengaman

Leave A Comment