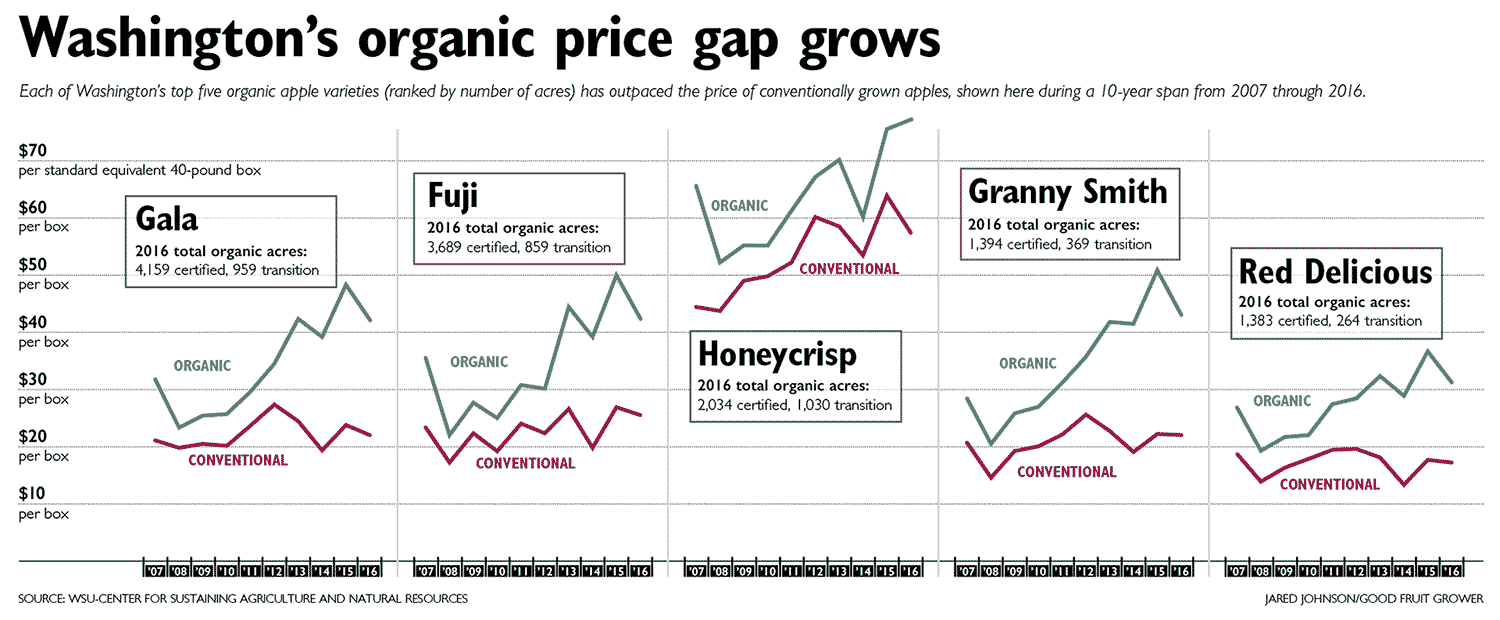

Washington’s organic price gap grows: Each of Washington’s top five organic apple varieties (ranked by number of acres) has outpaced the price of conventionally grown apples, shown here during a 10-year span from 2007 through 2016. (Source: WSU-Center for sustaining agriculture and natural resources. Jared Johnson/Good Fruit Grower)

Inspired by organic apple prices at a record $20 to $25 a box above their conventional counterparts, Washington growers continue to certify more orchards and harvested an estimated 13 million boxes in 2017.

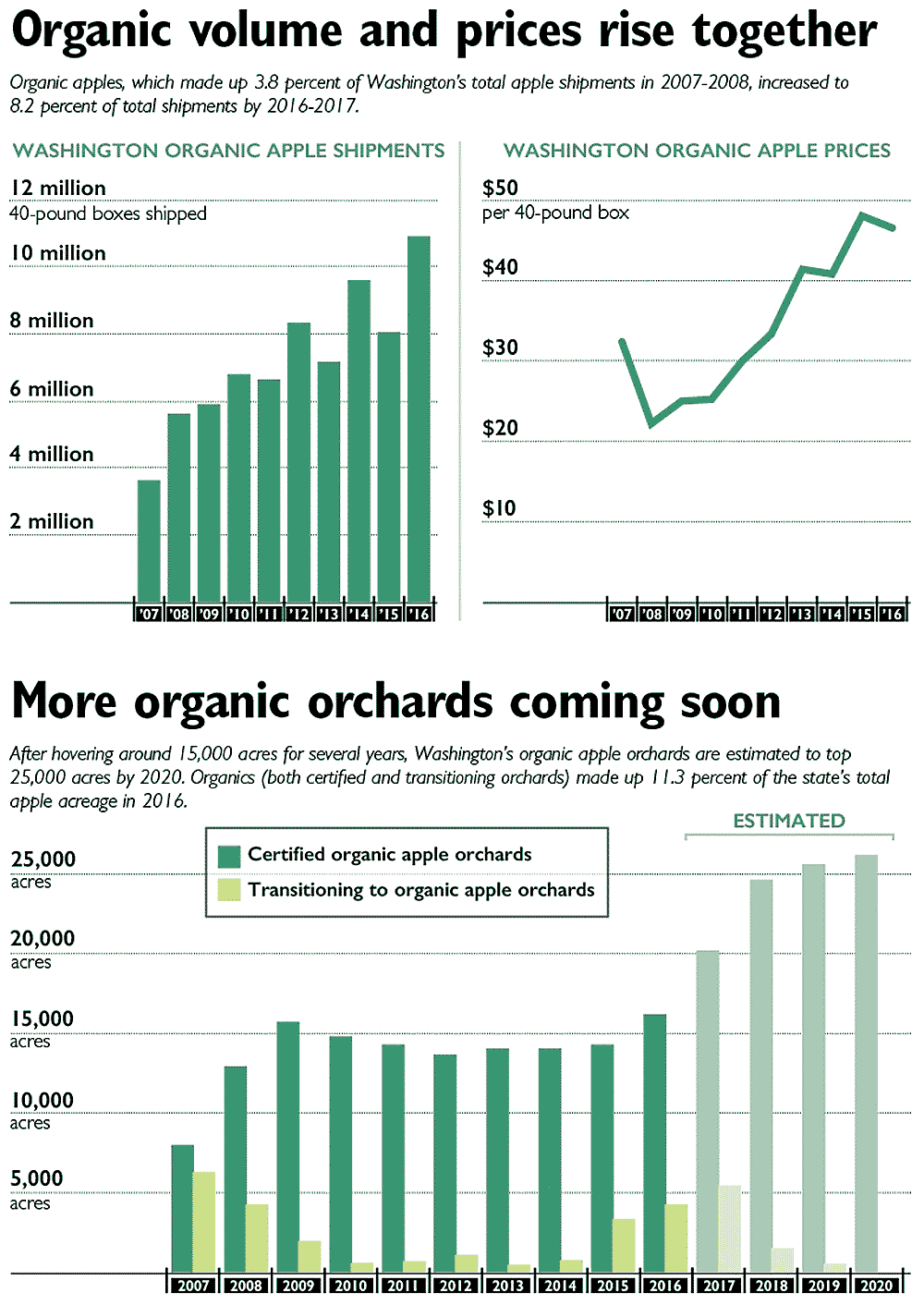

So far, that bet has paid off well for growers, but an expected boom in production this year and next could change the math. Prices might fall if supply outpaces demand this season when certified acreage is expected to jump dramatically to 25,000 acres, up from 16,000 in 2016, according to David Granatstein, a professor at Washington State University.

David Granatstein

“If there is going to be a year where there is a problem, it’s probably going to be next year,” he said in a fall interview. “But then, for the foreseeable future, it shouldn’t be a problem.”

Consumer demand for organic apples appears to be rising steadily at about 10 percent a year, so if the sudden boom predicted for 2018 causes a glut, it will be small and temporary, he said.

By 2019, demand is expected to slightly exceed supply again as acreage expansion slows. Granatstein presented his forecasts at the Washington State Tree Fruit Association Annual Meeting in December.

To make his forecasts, Granatstein relies on data from the Washington State Department of Agriculture on acres certified as organic and certified as in transition.

But since transition certification is optional and only used by some growers, he also conducted a private survey with packing houses in 2017 to see how many organic acres they expect to come online in the coming years.

“Just about half of what’s actually in transition based on my survey is registered with the certifier,” Granatstein said. “We’re all expecting the same thing this year and next year, two big years of growth and then it will flatten out.”

In 2016, Washington growers harvested 11.3 million boxes of organic apples. Due to biennial bearing, 2017 was expected to be an off-year, which could somewhat mask the recent growth.

But a strong harvest of 13 million boxes suggests it may not have been as off as expected, Granatstein said. Production could jump dramatically again this coming harvest if that huge increase in acreage aligns with an on-year for production, he added.

Organic volume and prices rise together: Organic apples, which made up 3.8 percent of Washington’s total apple shipments in 2007-2008, increased to 8.2 percent of total shipments by 2016-2017. More organic orchards coming soon: After hovering around 15,000 acres for several years, Washington’s organic apple orchards are estimated to top 25,000 acres by 2020. Organics (both certified and transitioning orchards) made up 11.3 percent of the state’s total apple acreage in 2016. (Source: WSU-Center for sustaining agriculture and natural resources. Jared Johnson/Good Fruit Grower)

The industry embraced organics as a growth opportunity, but given the rapid rates of growth, “at some point, organics will cut into conventional apple sales,” he said.

Studies show that consumer demand for organic products continues to rise. Sales for the organic ag sector rose 23 percent nationwide in 2016 to $7.6 billion, according to the U.S. Department of Agriculture, with apples accounting for $327 million in sales, up 8 percent.

Globally, Europe remains the leader in organic tree fruit production, with about 72 percent of the land in organic orchards.

Washington has 7 percent of the world’s acreage. Organic production is also increasing in South America.

The increase in production raises questions about export markets. American organic apples no longer have a home in European markets, but if the trend catches on with Asian consumers, that could create new opportunities for Northwest growers, Granatstein said.

“Right now, the bulk of our exports in organic apples and tree fruit goes to Canada,” he said.

The leading organic varieties are Gala and Fuji, followed by Honeycrisp, Granny Smith and Red Delicious. Cripps Pink are performing well as an organic apple and gaining ground.

The new Washington State University variety WA 38, to be sold as Cosmic Crisp, is expected to be a strong organic candidate as well, Granatstein said.

The Columbia Basin is leading the state in terms of organic apple acreage — with about 7,400 certified acres, compared to less than 3,000 acres each in the Yakima Valley and north central Washington, according to the U.S. Department of Agriculture’s 2017 Washington Tree Fruit Acreage Report.

Organic pear production, which has generally been more stable than apples, is growing too, with almost 400 acres reported in transition. Currently, it comprises just over 10 percent of Washington’s pear acreage. In 2016, pear growers sold more than 1.1 million boxes of organic pears for an average price of $37 a box.

Cherry growers have also begun certifying more acreage for transition again after challenges controlling spotted wing drosophila undercut rapid growth a decade ago. Organic cherries comprised just over 2 percent of the Washington crop in 2016. Prices remain strong, Granatstein said, thanks in part to the market for individual, quick frozen cherries, which keeps a floor under the price. •

—by Kate Prengaman

[…] Read more about boom times for organic apples from Good Fruit Grower’s January article here. […]