Bartlett pear halves. (Courtesy Pacific Northwest Canned Pear Service)

The Bartlett pear deal is in a healthy position, with both growers and canners feeling good about returns.

“The pear deal is as solid as it’s ever been, both fresh and processing,” said Steve Carlson with Del Monte Foods in Yakima, Washington.

Bartlett pears are grown in the Pacific Northwest for both the fresh and processed markets. Historically, more pears were processed than were sold fresh. For example, in 2004, two thirds of the total Bartlett crop of 227,000 tons went to canners.

Over the past decade, Bartlett production has been stable, but fresh demand has been strengthening. Meanwhile, the cannery business has been consolidating. There are now just three canners—Del Monte, Northwest Packing, and Seneca—where there used to be five.

Carlson said supply and demand are in good balance and processors’ inventories are low. The three processors are running at 80 or 90 percent capacity, up from 50 to 60 percent when there were more canners in the business, which makes them more efficient.

“In the past we’ve had inventory problems,” he said. “When you get oversupply, you carry too much inventory and people start dropping the prices.

“What’s holding this so solid now is we don’t have an oversupply. We’re not going out and planting thousands of acres of pears. It’s very stable. Canners are making money; growers are making money.”

Record prices

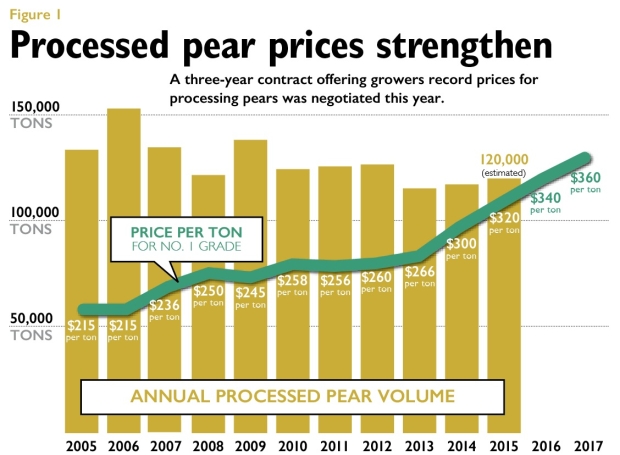

A three-year contract offering growers record prices for processing pears was negotiated this year. Source: Washington-Oregon Canning Pear Association. (Jared Johnson/Good Fruit Grower)

Earlier this year, the Washington-Oregon Canning Pear Association negotiated a contract that gives growers higher returns on processing pears than ever before. The price for No. 1 grade Bartletts is $320 per ton in 2015, up from $272 in 2014. The three-year contract will give growers $340 a ton in 2016 and $360 in 2017. (Figure 1)

Jay Grandy, manager of the Canning Pear Association, said the 2015 total Bartlett crop is forecast at 228,000 tons (down from 238,000 tons last year), but the processed share could increase to 120,000 tons (up from 117,000 tons last year). The fresh crop is likely to be around 98,000 tons, with the remainder going for juice.

Grandy said the higher prices for processing pears could be a factor in more pears going to canners, but the weather is probably a greater influence. Fruit from orchards hit by this spring’s hail storms will be processed, rather than sold fresh.

Scarce supplies

The Pacific Northwest Canned Pear Service, which promotes canned pears, changed its strategy last fall when canned pear supplies were scarce. Rather than promoting pears through food service distributors, it placed more emphasis on strengthening demand for pears by end-users, such as schools and colleges.

Mark Miller, promotion director for the Canned Pear Service, said schools are serving pears more frequently because of recent government regulations that require schools to serve more fruits and vegetables. Regional manager Rensi Shirley, who covers the eastern United States, said that canned pears are now appearing on school menus at least once a week, rather than once or twice a month.

The Canned Pear Service offers merchandising and technical assistance to food service operators and distributors, offers purchasing and promotion incentives, and publicizes pears in the media.

The Fresh Pear Committee, which administers the federal marketing order for Northwest processed pears, approved a budget of $667,000 for the Canned Pear Service for the coming year, a similar amount to last year.

Growers pay an assessment of $7 per ton on processed pears, of which $5.50 goes to promotions, $1 funds pear research projects, and $0.50 covers administration. The Processed Pear Committee allocated almost $133,000 for research in the coming year. Its total budget for 2015-2016, based on a projected processed pear crop of 115,000 tons, is just over $850,000. •

Leave A Comment