Miscalculating worker wages in the age of mandatory rest break pay, down time pay and overtime pay may result from an honest mistake.

But that doesn’t lower the stakes.

“This is all a litigation risk,” said Sean Worley, an attorney at the Stokes Lawrence law firm in Yakima, Washington, known for representing agricultural employers.

Worley and Enrique Gastelum, CEO of wafla, held a webinar in late April to help Washington growers avoid mistakes, and therefore fines, from regulators and lawsuits from labor-rights advocates, both of whom are watching agricultural wages with increased scrutiny in recent years. Wafla is an agricultural human resources nonprofit responsible for the bulk of the Northwest’s H-2A contracts.

The most important factor, they said, is determining regular rate.

“We want to ingrain that in everybody’s brains today,” Gastelum said.

Minus rare exceptions, Washington state law defines “regular rate” as everything — base pay, piece rate, overtime and bonuses — the employer pays to its employee. It’s determined by dividing total compensation in a workweek by the total hours worked, and it’s often different than hourly wage, even if paying straight by the hour.

A host of potential pitfalls await the calculation of regular rate, they said. Weighted averages (using a mixture of hourly and piece rate in the same week), differentiating piece-rate active time from down time, and production-based bonuses all count as total compensation and therefore must be baked into the regular rate. Also, Washington’s overtime threshold shifts: It’s 55 hours this year but will drop to 48 on Jan. 1, 2023.

The differences may seem small at first glance, Worley said, $5 or $10 for one employee. But Washington’s statute of limitations allows for three years of back pay and double damages. Multiply that by hundreds of workers and throw in attorneys’ fees for a lawsuit.

“A minor mistake like that can go a very long way in making a very expensive issue for you,” Worley said.

Another definition to keep in mind: nondiscretionary bonus. Examples include extra money paid to a worker as an incentive to harvest more volume, stay the length of a season or refer other employees. If the worker does those things, that worker can expect that bonus, making it nondiscretionary. It must be added to total compensation and, therefore, the regular rate. Don’t try to casually tack on a nondiscretionary bonus at the end of all the calculations.

Here’s one more nugget from the webinar: Figure out overtime by first determining the regular rate for the total hours worked, then add the few hours that exceeded the overtime threshold at half the hourly rate, which is the overtime premium, Worley said. A common mistake is to pay the total hours and then pay the overtime hours at 1.5 times the hourly rate. That would be overpaying.

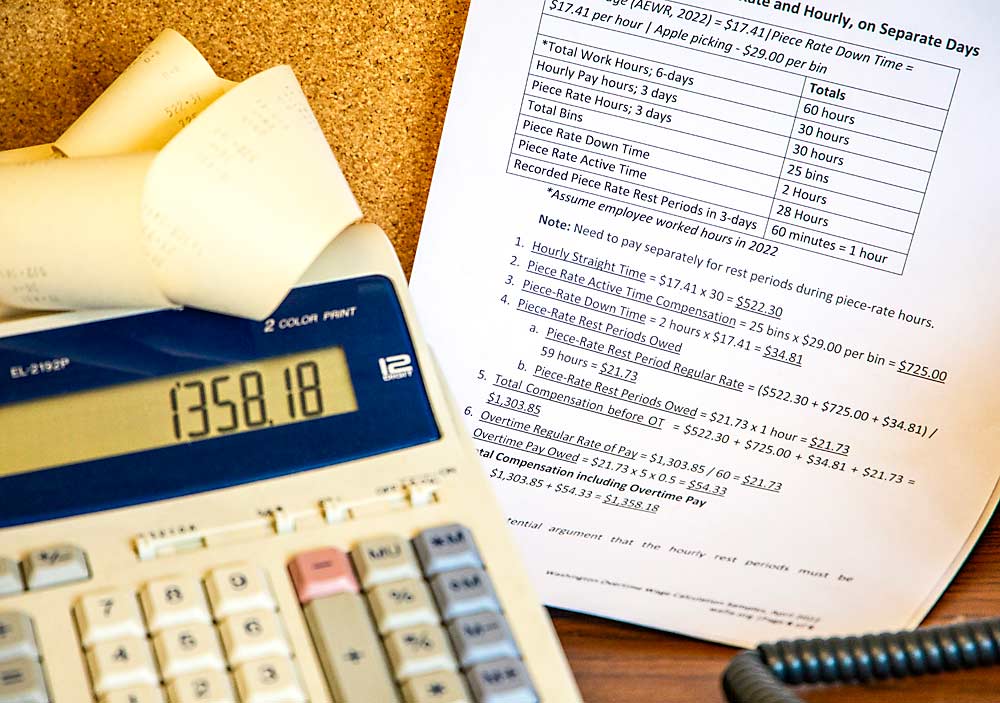

To help keep these rules straight, Gastelum and Worley walked through six fictional examples of the most common pay scenarios used on Washington farms.

—Hourly earnings with overtime.

—Hourly earnings with overtime plus a retention bonus.

—Piece rate with overtime.

—Piece rate with overtime plus a bonus.

—Hourly earnings plus a productivity bonus with overtime.

—A combination of piece rate and hourly wages on separate days within the same workweek.

The math for each scenario is available to download at the end of this story. The examples are helpful and accurate, Worley and Gastelum said, though they should not be taken as legal advice.

Many growers use labor-tracking apps, such as PickTrace or FieldClock, that automatically calculate wages. That’s fine, but the grower is ultimately responsible for paying wages correctly, they said.

Worley and Gastelum recommend growers work with their app vendors to make sure the software calculates wages correctly.

“I think a lot of the software providers do a good job, but I do find mistakes here and there sometimes when I’m working with my clients,” Worley said. •

—by Ross Courtney

Leave A Comment