Whether they’re club apples, new apples, old apples, or just apples, there are a lot of apples being produced in North America, and more coming from a spate of recent plantings.

John Rice, who is in charge of marketing for Rice Fruit Company of Gardners, Pennsylvania, asks, “Who’s going to sell them? And who’s going to buy them? And at what price?”

Speaking to growers during the International Fruit Tree Association annual conference in Halifax, Nova Scotia, in February, Rice traced the apple production curve since he began working the sales office at Rice Fruit in 1975.

That year, he said, there was a record U.S. crop of 175 million bushels—160 million was the record until then.

“There was great trepidation about what we were going to do with an extra 15 million bushels of apples in the country,” he said. “The apple market was a disaster that year, and many, if not most, growers lost money.”

In 2014, the country again produced an all-time record crop, now in excess of 275 million bushels. And apple prices have dropped considerably. But there are some different factors in the market now, and Rice is not sure what they all mean.

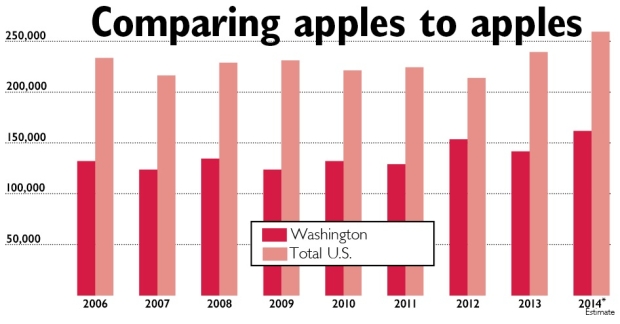

First, he does think growers have planted too many apples, and he pointed a particular spotlight at Washington State, which has increased production the most, both in terms of bushels and as a percentage of the total U.S. crop.

While there has been some growth in production in New York, Michigan, and Pennsylvania, Washington’s production has gone from 52 million boxes in 1976 to nearly 152 million boxes last year, and a surprising amount of that growth has taken place in just the last five years. Two-thirds of all U.S. apples are now grown in Washington State.

“As a frame of reference, the state of Pennsylvania has traditionally grown around 4 to 5 million boxes of fresh apples out of a total crop of 12 million bushels year after year,” he said. “You can imagine that we wish other states would follow our record of consistency and restraint.”

Second, the growers in Washington have had some unusual luck, both good and bad, in the last few years that may have masked, at least for a time, the full price effects of these big crops.

In 2012, for example, Washington had a huge crop—21 million more boxes than ever before. But they were saved—in fact, they enjoyed great prices—because growers in the East were frozen out by enormous April frosts. Both Canada and Mexico

—Washington’s two biggest export customers—also had very reduced crops.

There have been market disruptions this year that have had a big effect on the market for the huge 2014 crop—but in the opposite way. Would the extra apples have moved at better prices without the fruit embargo by Russia, or the slowdown in shipping from the West Coast container ports, or the big crops in Canada, Mexico, and Europe?

Yet some apples have done well, even in this big crop year.

“Even with the massive crop Washington grew in 2014, some apple growers are still doing very well,” Rice said. “Those are the growers who are turning out 2,000 bushels per acre of the apples that American consumers want today, especially Honeycrisp and Gala. Those two varieties should still make money for Washington growers this year.”

“Organic apples are also doing surprisingly well,” he said. “But few other apples will make money this year. Not Red Delicious, not Golden Delicious, not Jonagolds, not Granny Smith, not even Fujis.

“Even as f.o.b. prices for several varieties are languishing at levels close to the cost of packing, Honeycrisp prices at both the wholesale and the retail level are sky high in comparison,” he said. “Right now it is easy to see Red Delicious apples selling at retail for $.79 per pound beside Honeycrisp selling for $3.99 per pound.”

Is that the answer: Grow more Honeycrisp and find more varieties like them? That seems to be the path apple growers are on.•

hi there

i live in Iran and i am looking some one or a company to wholesale apple fruit from Iran to all over the world and deliver the apples in BANDAR ABBAS PORT persiaon gulf .