First, I would like to say to my fellow cherry growers, we should probably start a Cherry Gamblers Support Group.

Life as a grower is like taking all of your production money to Vegas in November and throwing it on the gambling table. Literally, you are betting on the farm. The most nerve-wracking part is you won’t know if you won or lost until you receive your pool closing settlements. In the case of cherries, that is almost a year from the time you started investing in that crop.

Most of the time, you at least break even, with — hopefully — enough profit to fund the next year. Occasionally, you will be blessed with a “ring the bell” year where you can set aside next year’s production money, pay off debt, invest in improvements and maybe even purchase another cherry orchard. We won’t explore “why” we would purchase another cherry orchard, but a support group is probably a good idea.

And then there are times when you literally lose everything. Your crop is a total loss. Each year, you are just one ill-timed weather event away from a potential crop failure.

Other commodities, like apples and pears, face this same investment cycle. However, cherries are more sensitive to weather events, especially just prior to harvest. In those last critical weeks, we are constantly monitoring weather forecasts, tracking weather systems, and are often scrambling to adjust plans accordingly. Each new crop season is potentially fraught with peril at the mercy of the weather.

So, you ask, what helps me sleep at night? Cherry crop insurance. And if you don’t currently have crop insurance, I ask that you please keep on reading.

When I was first introduced to cherry crop insurance over 10 years ago, I was very resistant. I had heard so many other growers say, “It’s a waste of money.” However, when we later purchased a larger orchard, it became a requirement for our ag loan.

Thankfully, I had the good fortune of finding an agent who patiently explained everything and walked me through the enrollment process. I must admit that I was skeptical at first and really didn’t pay much attention to the policy for the first couple of years. I just paid my premiums each year wondering if it was worth it.

Then one year, we were hit with rainstorms just prior to harvest. Each day, we were losing more of our crop. Many sleepless nights, refreshing the weather app, helicopters on standby, tractors with sprayers fueled up and ready to go. We were in a battle to save whatever crop we could. In the middle of the chaos, my phone rang. It was my agent asking if we had any damage and if we needed to start a claim.

He then explained my “worst case scenario” for my revenue guarantee for the crop. Now that I was down in the trenches, I finally understood the great value of the program. I could finally sleep at night from that year forward. It allowed me to approach each year with best farming practices and not trying to cut corners. Going into each year, I know I can cover my growing costs and pay my fixed costs and debt payments.

In general, your revenue guarantees are based on your own actual revenue history (ARH) from your own blocks. So, if you have a high-performance revenue block, whether due to variety or harvest timing, you get full credit for its actual revenue. If you have a low-performance block, again, whether due to variety or harvest timing, you will only get credit for that block’s revenue. If you have a bad year where you need to make a claim, this will be accounted for in your ARH and therefore your revenue guarantee.

Your neighbor down the road only gets credit for their actual revenue on their own blocks. Basically, each policy is tailor-made for your farm based on your block performance. Effectively, it is self-correcting to average out your highs and your lows.

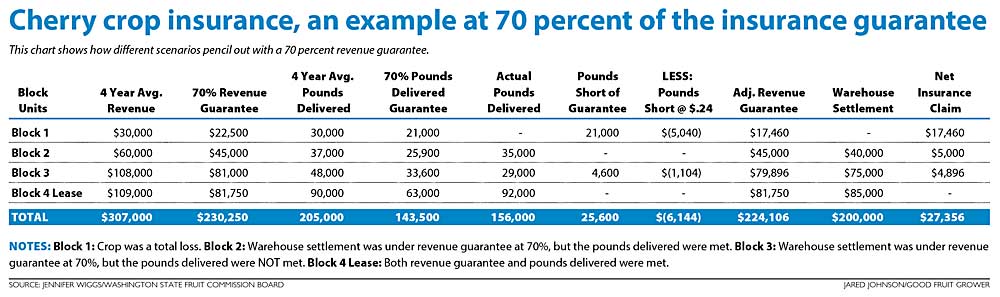

The revenue guarantee, and therefore premiums, are based on your ARH. I should note there is also a factor for the average production history in pounds for your policy. Once you receive the proposal, you then have the choice of what percentage of that revenue guarantee you would like. The premium will be based on the percentage of coverage that you choose.

Another benefit of cherry crop insurance is you are already in the U.S. Department of Agriculture database, along with all of your data. So, if there are any USDA programs available, like disaster relief funds, this will make the application process easier. In some programs, crop insurance is required before you can even apply.

I’m not selling insurance, but from one grower to another, I recommend exploring the possibilities with an agent who specializes in cherries. If you already have it, I recommend reviewing your revenue guarantee percentage options each year and adjusting accordingly. My hope is that others can sleep better at night, too.

Get to know your insurance options

Actual Revenue History: You are required to provide last year’s pool closing to enroll, which includes all lease blocks. However, I recommend you provide your last four years of history. Your agent will use the greater of your actual revenue or the published county average per year to establish the four-year average for the policy.

Insured units: Your agent will need all of your block details to establish your insurable units based on the policy guidelines. Some of your blocks may be combined into a single unit. This should include the address, year planted, row spacing, variety and rootstock per block. If you have the satellite image of your blocks outlined, that would be helpful.

Cash requirements: Create a budget of your cash requirements, including expenses, debt payments and other fixed costs. This will help you with the next step in choosing the right percentage of coverage options.

Percentage of guarantee: Your agent will provide you with a proposal including percentage of guarantee options along with the associated premiums. Refer to your cash requirements amount to help you analyze and make the best decision for your farm.

Insurance premium: Don’t forget to include the premium in your cash requirements. Premiums are due in the fall each year.

—by Jennifer Wiggs

Jennifer Wiggs and her husband, Joe, own a cherry orchard in Wenatchee, Washington. She’s also a board member of the Washington State Fruit Commission.

Talking cherry risks with the Risk Management Agency

In September, I had the great privilege to accompany Mark Powers and Riley Bushue of the Northwest Horticultural Council and B.J. Thurlby of the Washington State Fruit Commission on a trip to Washington, D.C., to advocate for cherry crop insurance.

This trip was prompted by rumors of potential changes that could adversely affect our current Actual Revenue History (ARH) insurance program by introducing a different program, Production and Revenue History (PRH). This alternative product works well for some specialty crops, but it is structured in a different way. Our current ARH product works very well for our cherry industry, so our biggest concern was ensuring that our ARH program would still be available if the PRH program was offered.

We were fortunate to meet with the administrator of the U.S. Department of Agriculture Risk Management Agency (RMA), Marcia Bunger, to express our concerns. Bunger is a farmer as well, so she was able to relate to our industry and understand the differences compared to her farm in Nebraska. We explained our cherry industry and the unique production challenges the growers face each year. In addition, we demonstrated how the ARH program works well for us and remains actuarially sound.

We were assured that if the PRH program was offered, our current ARH would always be an option.

The meeting went exceptionally well, and we made a favorable impression that will be useful in the future. The agency even asked if we would host a cherry orchard tour next summer — to which we answered, “Yes!”

—Jennifer Wiggs

Leave A Comment