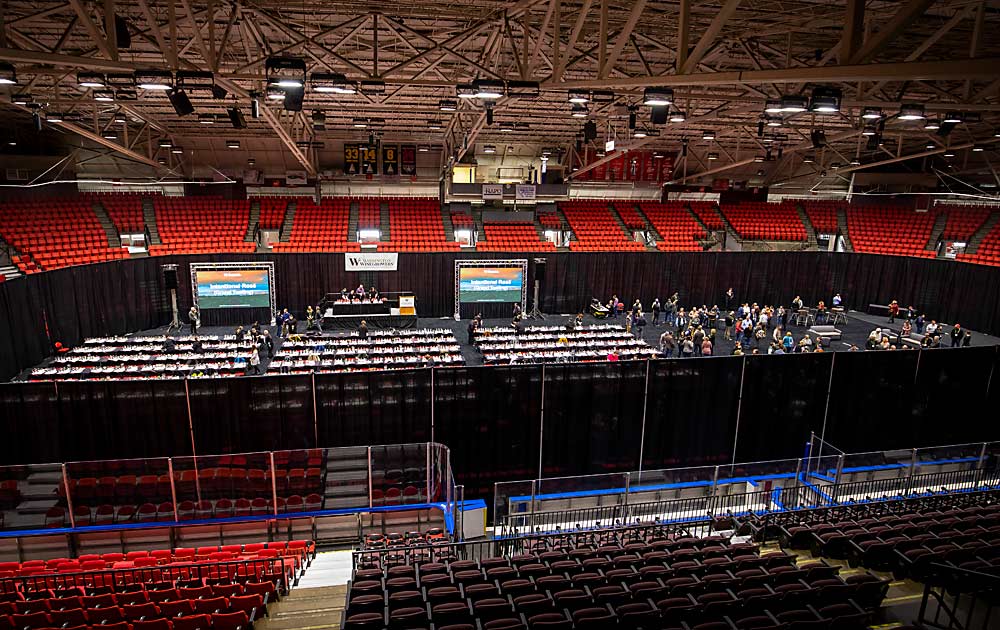

Attendees who braved the recent snowfall in the Pacific Northwest take a short break between sessions during the 2019 Washington Winegrowers Association convention and trade show on Tuesday, February 12, 2019. The main educational sessions take place here, on the ice of the Toyota Center at the Three Rivers Convention Center in Kennewick, Washington. (TJ Mullinax/Good Fruit Grower)

The future for the Washington wine industry remains bright, but some headwinds are coming in the near term that could dampen future prospects.

That’s the word from wine economist Chris Bitter of Vintage Economics at the Washington Winegrowers annual conference in Kennewick, Washington.

“The key is to have realistic expectations, and you’re going to need to be very strategic in order to thrive in this type of environment,” Bitter said Tuesday on day one of the conference. “Rapidly evolving markets definitely create opportunities, but you have to be innovative and do your homework to figure out where those opportunities are.”

Wine consumption generally has slowed, which has resulted in excess supply on a global basis.

What has that meant for Washington?

According to the Washington State Liquor and Cannabis Board, packaged wine shipments grew 50 percent, or 4.2 million cases, from 2010 to 2016. Ste. Michelle Wine Estates accounted for 2.6 million cases.

Two key points can be drawn from those figures, Bitter said. One: Washington is heavily reliant on one company for that growth. Two: The state is heavily dependent on out-of-state demand. Out-of-state shipments represented 85 percent of that gain over the time period.

In 2017, total Washington shipments declined 5 percent, a sharp reversal from the annualized 7 percent increase of the previous six years.

The declines showed up in both out-of-state and in-state distribution, while direct-to-consumer sales at the winery were up (that includes both in-state and out-of-state retail sales at the winery).

Preliminary numbers for 2018 show shipments were up 3 percent — still 250,000 cases below the 2016 peak, so Washington has plateaued, he said. In addition, Washington is seeing bifurcation of its industry between its biggest player and the rest of the industry.

Ste. Michelle, which represents well over 60 percent of Washington wine shipments, was down 1 million cases from its peak in 2016, while the rest of the industry is up by 750,000 cases over the last two years, he said.

“A lot of the gain in 2018 was due to other wineries in the state,” he said. “The majority of the state’s top 100 wineries recorded solid volume gains.”

Nationally, competition from alternative alcoholic beverages, a focus on a healthier lifestyle, and the millennial generation drinking less wine, together are contributing to a plateau in wine sales, Bitter said. The $11 and under segment of the market is contracting, which reflects why Ste. Michelle shipments are down, but premium and higher-priced segments of the market continue to do well.

The overall economic outlook for 2019 is for a modest slowdown — a moderating economy, not a recession, though experts say a recession is coming, he said. With a trade war, political gridlock in the U.S. and a slowing global economy, the risks are clearly to the downside.

“We have the second-longest economic expansion on record, and an unemployment rate somewhere near a 50-year low,” he said. “It’s hard to squeeze additional growth, so we’re going to see a recession at some point.”

For the wine industry, that means retail sales should continue to be the sweet spot, though there will be intensifying competition in every segment. “We have a strong dollar, excess global supply, which means more pressure from imports,” he said.

Washington had an explosion of satellite tasting rooms open in the last few years; as of 2018 year-end, there were 233 active additional location licenses in the state, with 40 issued in 2018 alone. More locations equal more competition for direct-to-consumer dollars.

In the grape market, growers have planted for strong demand, but now there’s an oversupply. Ste. Michelle, in particular, has cut back on some of its contracts; going forward, the outlook depends heavily on fortunes there.

“If they’re not expanding and taking on more grapes, the rest of the industry simply isn’t big enough to take up the slack,” he said. The company has the best value for the price, and Bitter said he expects to see their shipments turn around, “but these things take time.”

—by Shannon Dininny

Leave A Comment